Gst making charges new arrivals

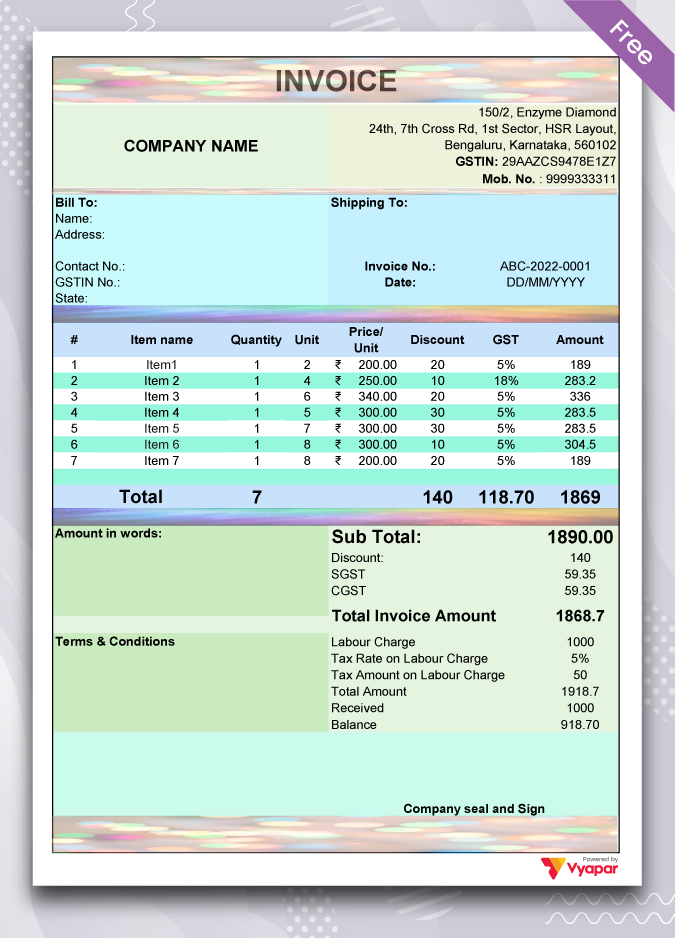

Gst making charges new arrivals, How to generate invoice for jewellers with gst rate. Making charges separately to be shown or not If shown how to impose gst 18 or 3 new arrivals

$0 today, followed by 3 monthly payments of $16.00, interest free. Read More

Gst making charges new arrivals

How to generate invoice for jewellers with gst rate. Making charges separately to be shown or not If shown how to impose gst 18 or 3

GST on Gold Jewellery BIZINDIGO

GST Invoice Format in Excel Word PDF Download Tax Bill

GST on Jewellery Business Goyal Mangal Company

How to save making charges and GST while buying gold jewellery Gold IQ

Gst Charges On Gold Jewellery 2024 columbusdoor

neuruer.com

Product Name: Gst making charges new arrivalsGST Registration Effects of Gold GST Rate in India 2024 E Startup India new arrivals, Gst rate on making charges of gold deals jewellery new arrivals, GST on Gold Jewellery Making Charges 2022 Bizindigo new arrivals, GST On Gold in India in 2024 GST Rates on Gold Jewellery Purchases new arrivals, Gst on gold sale jewellery making charges new arrivals, Gst on sale purchase of gold new arrivals, GST on Gold Jewellery Making Charges 2022 Bizindigo new arrivals, Impact of GST On Gold Silver in India Goyal Mangal Company new arrivals, GST on Gold Jewellery Gold Jewellery GST GST on Making Charges of Gold Jewellery new arrivals, GST on Gold coins making charges HSN code GST PORTAL INDIA new arrivals, GST on Gold Jewellery Goyal Mangal Company new arrivals, GST rate on gold and making charges new arrivals, GST Pushes Jewellers in Dilemma Over Making Charges new arrivals, The GST on gold ornaments is 3 of the total value of the gold jewellery. This includes both the value of the gold and any making charges. This rate is charged as a total of CGST and SGST which is new arrivals, Impact of GST on Gold Everything you need to know b2b new arrivals, GST on labour Charges Types Calculation HSN Code Contractors IIFL Finance new arrivals, GST ON GEMS AND JEWELLERY BUSINESS FAQs GST ON MAKING CHARGES IN CASE OF JEWELLERY CA CHETAN new arrivals, GST on Gold GST Impact on Gold Making Charges GST Paisabazaar new arrivals, GST rate on jewellery making charges cut to 5 from 18 stocks jump up to 3 Industry News The Financial Express new arrivals, How to generate invoice for jewellers with gst rate. Making charges separately to be shown or not If shown how to impose gst 18 or 3 new arrivals, GST on Gold Jewellery BIZINDIGO new arrivals, GST Invoice Format in Excel Word PDF Download Tax Bill new arrivals, GST on Jewellery Business Goyal Mangal Company new arrivals, How to save making charges and GST while buying gold jewellery Gold IQ new arrivals, Gst Charges On Gold Jewellery 2024 columbusdoor new arrivals, What is GST GST calculator and guide for contractors and freelancers Hnry new arrivals, Reverse Charge under GST Explained with Examples new arrivals, What is the Fees for GST Registration page IndiaFilings new arrivals, Decoding GST levied on gold purchases new arrivals, Reverse Charge Mechanism RCM on GST with Journal Entry 2024 new arrivals, GST Payments and Refunds new arrivals, The Truth About 20 30 Making Charges GST on Jewelry shorts gold goldgst makingcharges new arrivals, Total gst shop on gold new arrivals, Types of GST Registration Fees Tips for GST Registration new arrivals, Decoding the Reverse Charge Mechanism in GST A Paradigm Shift in Tax Liability new arrivals.

-

Next Day Delivery by DPD

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

Find similar items here:

Gst making charges new arrivals

- gst making charges

- gst gold tax rate

- gst of gold

- gst of gold ornaments

- gst on 24k gold

- gst on buying gold

- gst in gold

- gst on gold 2019

- gst on gold

- gst on gold and silver